Medicare Health Coverage in Santa Barbara, CA: What You Need to Know Before Enrolling

Turning 65 should feel exciting. A new chapter. More freedom. But for many people, Medicare decisions bring stress instead. There are forms. Deadlines. Plan choices. Too many unfamiliar terms.

If you feel unsure, that’s completely normal. Many people do.

This guide explains Medicare in plain language. No complicated jargon. Just clear steps. You will learn how coverage works, what it costs, and how to choose the right path for your situation.

Most importantly, you will see how local guidance can make the process easier.

Why Medicare Health Insurance Planning Matters More Than You Think

Medicare is not just another insurance decision. It affects your finances, your doctors, and your long-term security.

A small mistake can create problems later. For example:

- Late enrollment penalties that never go away

- Choosing a plan that does not include your doctor

- Higher out-of-pocket costs than expected

- Gaps in prescription coverage

The good news is simple. With the right planning, these problems are avoidable.

When people understand their options early, they feel relief. Confidence replaces worry.

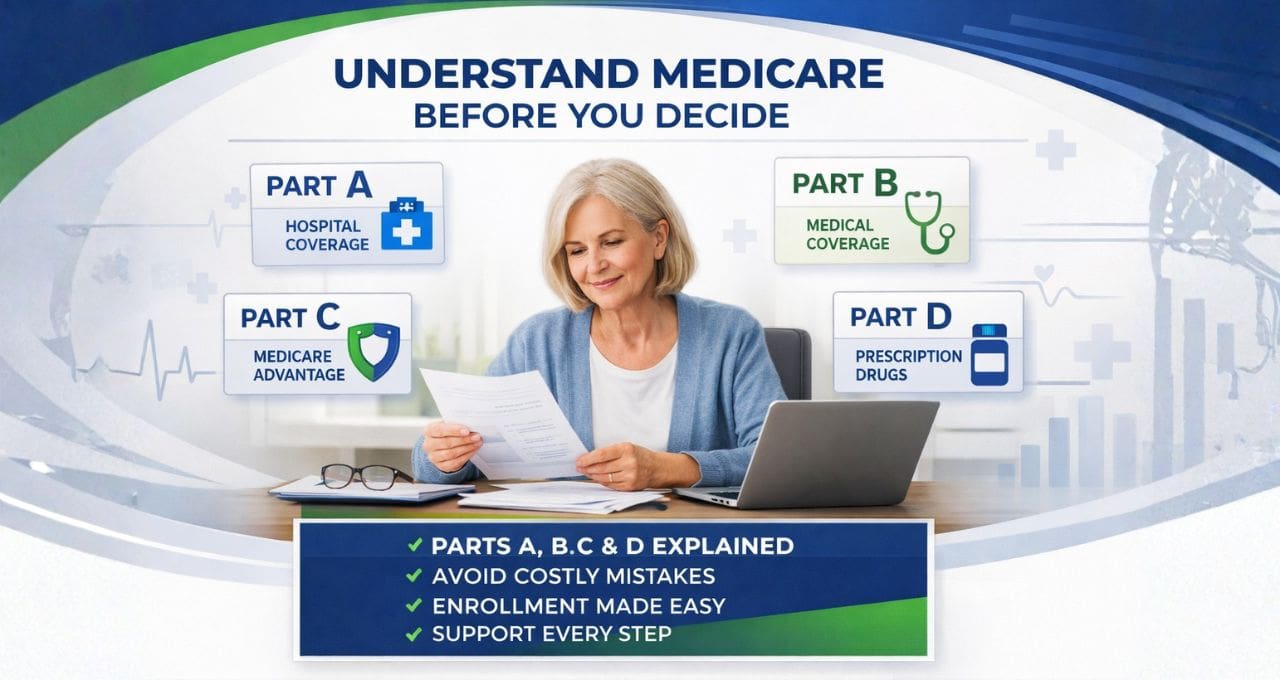

Understanding Medicare Basics (Without the Confusion)

Medicare has several parts. Each covers something different.

Here is the simplest way to think about it.

Part A: Hospital Coverage

Part A helps pay for:

- Hospital stays

- Skilled nursing care

- Hospice services

- Some home health care

Most people do not pay a monthly premium for Part A if they worked long enough.

Part B: Medical Coverage

Part B covers everyday medical needs:

- Doctor visits

- Outpatient services

- Preventive care

- Lab tests

- Durable medical equipment

Part B does have a monthly premium. It changes each year.

Part C: Medicare Advantage Plans

These plans are offered by private insurance companies. They combine Parts A and B, and often include extra benefits like:

- Prescription drug coverage

- Dental or vision

- Fitness programs

Costs and provider networks vary. Some plans have lower premiums but more restrictions.

Part D: Prescription Drug Coverage

Part D helps pay for medications. Plans differ in:

- Monthly premiums

- Covered drug lists

- Pharmacy networks

Choosing the wrong plan can mean paying more than necessary.

Medigap (Medicare Supplement Plans)

Medigap policies help cover costs that Original Medicare does not pay, such as:

- Deductibles

- Coinsurance

- Copayments

These plans provide predictable expenses. Many retirees like that stability.

Medicare Plan Options in Santa Barbara, CA

Healthcare access varies by region. That matters when choosing Medicare coverage.

In Santa Barbara, key factors include:

- Local hospital systems

- Physician networks

- Specialist availability

- Regional plan pricing

Some Medicare Advantage plans work well locally. Others may limit doctor choice.

This is where guidance helps. A plan that looks good online may not fit your actual healthcare needs.

Many people want to keep their doctors. That concern is very common.

How Much Medicare Health Insurance Costs in Santa Barbara

Costs depend on the coverage path you choose. There is no single number for everyone.

Typical expenses include:

Monthly Premiums

- Part B premium (standard nationwide amount)

- Advantage or Part D plan premiums

- Medigap premiums if selected

Out-of-Pocket Costs

- Deductibles

- Copays for visits or services

- Coinsurance percentages

Maximum Exposure

Advantage plans usually have an annual out-of-pocket maximum. Original Medicare with Medigap may provide more predictable costs instead.

Some people prioritize lower monthly premiums. Others prefer stability and fewer surprises.

Both approaches can be valid. It depends on your situation.

When and How to Enroll in Medicare

Timing matters more than most people realize.

Initial Enrollment Period

This window begins:

- Three months before your 65th birthday

- The month you turn 65

- Three months after

Missing this period can lead to penalties.

Special Enrollment Period

If you have employer coverage past age 65, you may qualify for a special enrollment window later.

Annual Enrollment Period

Each year, you can review and change certain plans during the fall enrollment season.

Many people assume enrollment is automatic. That is not always true.

Planning ahead removes stress.

Medigap vs Medicare Advantage: How to Choose

This is one of the biggest decisions.

Here is a simple comparison mindset.

Medicare Advantage May Fit If You:

- Prefer lower monthly premiums

- Are comfortable with provider networks

- Want bundled benefits in one plan

- Do not travel frequently

Medigap May Fit If You:

- Want predictable healthcare costs

- Prefer freedom to see specialists

- Travel often within the U.S.

- Value long-term stability

Neither option is universally better. The right choice depends on health needs, finances, and lifestyle.

That’s why personalized advice matters.

Why Working With Local Medicare Agents Matters

Online enrollment tools exist. But they cannot understand your personal situation.

Local advisors can help you:

- Compare multiple insurance carriers

- Check doctor networks

- Estimate total costs

- Understand enrollment rules

- Avoid penalties

- Adjust coverage as needs change

Many people feel overwhelmed before speaking with an advisor. Afterward, they feel calmer.

Clarity changes everything.

Why Santa Barbara Residents Trust CoreGen Insurance Agency, LLC

Choosing Medicare coverage is not just a transaction. It is a long-term relationship decision.

Clients value working with professionals who listen first.

We focus on:

- Personalized Medicare guidance

- Access to multiple insurance carriers

- Local healthcare knowledge

- Clear explanations without pressure

- Ongoing policy support

- Annual reviews and adjustments

Many clients appreciate having someone they can call when questions come up later. That sense of support brings peace of mind.

Medicare is not a one-time decision. Needs change over time. Having a trusted advisor helps you stay protected.

Frequently Asked Questions

Q. When should I enroll in Medicare?

Most people enroll around age 65 during their Initial Enrollment Period. If you have employer coverage, your timing may differ. Planning early prevents penalties.

Q. What does Medicare cost in Santa Barbara?

Costs vary based on premiums, plan type, and healthcare usage. Some people focus on lower premiums. Others prefer predictable expenses with supplemental coverage.

Q. Do I need supplemental insurance?

Not everyone does. But many people choose it to reduce out-of-pocket risk and increase financial predictability.

Q. Can I keep my doctor?

Often yes, but it depends on the plan. Checking provider networks before enrolling is very important.

Q. What is the difference between Medigap and Medicare Advantage?

Medigap supplements Original Medicare and helps cover costs. Advantage plans replace Original Medicare with a private plan that includes additional benefits and network rules.

Q. What happens if I miss enrollment?

You may face late penalties or coverage delays. Some penalties last for life. This is why timing guidance matters.

Q. Should I work with a Medicare agent?

Many people find it helpful. Agents can compare plans, explain rules, and support you after enrollment.

Q. Are local agents better than online enrollment?

Local advisors understand regional healthcare systems and can provide personalized support. That often makes decisions easier.

Confidence Starts With the Right Guidance

Medicare decisions can feel intimidating at first. You are not alone in that feeling.

The good news is this. With clear information and experienced guidance, the process becomes manageable. Even comfortable.

The goal is simple. Protect your health. Protect your finances. And move into retirement with confidence.

If you have questions or want to explore your health insurance options, a short conversation with a trusted Medicare insurance provider can bring clarity. Professional guidance helps you avoid costly mistakes and choose coverage that truly fits your life.